About Us

Finances & Investments

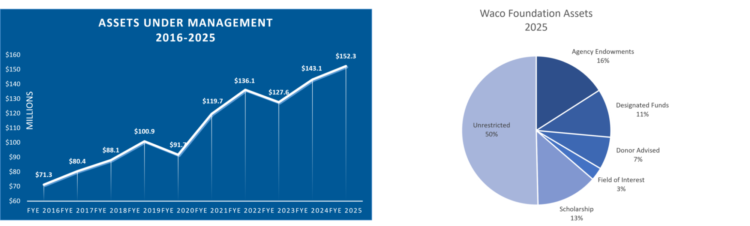

Waco Foundation manages $140 million in assets held in over 200 component funds, all for the purpose of improving quality of life in McLennan County.

Waco Foundation is committed to protecting the long-term value of the assets entrusted to our care. The Foundation's Board of Trustees is responsible for managing all financial activity, including investments, grantmaking and gift acceptance. The Board's Finance and Investment Committees work hard to ensure excellent stewardship of the community's charitable dollars.

Dillon Meek, Chair

Jed Cole

David Dickson

Malcolm Duncan, Jr.

Chris McSwain - Chair

Soo Battle

Dillon Meek

Click on the chart below to view financial information about the Foundation.

Audited financial statements, prepared by Jaynes, Reitmeier, Boyd and Therrell, P.C., are available upon request. The Foundation's IRS Form 990 is available at our office and on Guidestar.

Waco Foundation is committed to protecting the long-term value of charitable assets under management.

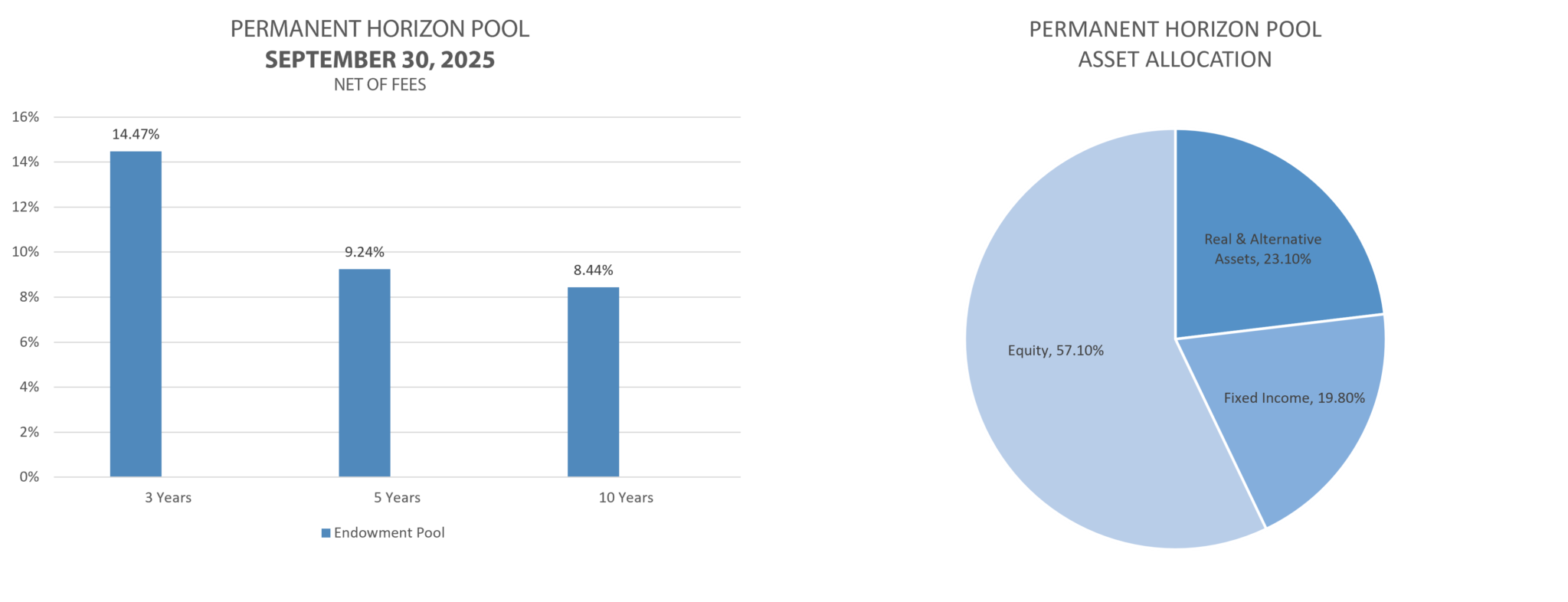

Proper stewardship of charitable dollars is essential to the Foundation's ability to build philanthropic funds in service to the community. Waco Foundation's investment goal is to earn a return that protects endowed funds' purchasing power over time and allows for a 5% spend rate to provide a steady stream of income to the organization or cause the fund supports. This is achieved with a carefully designed, diverse asset allocation strategy which includes both active and passive investment management and a balanced approach to managing risk and return.

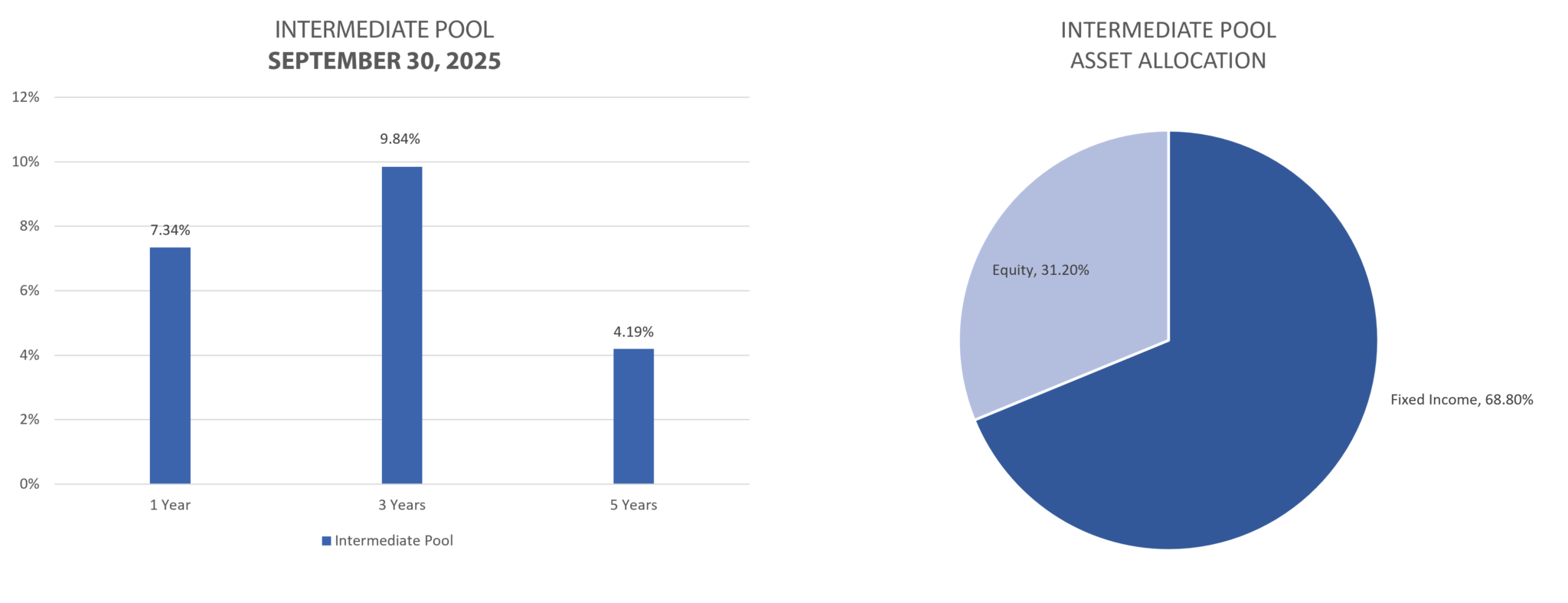

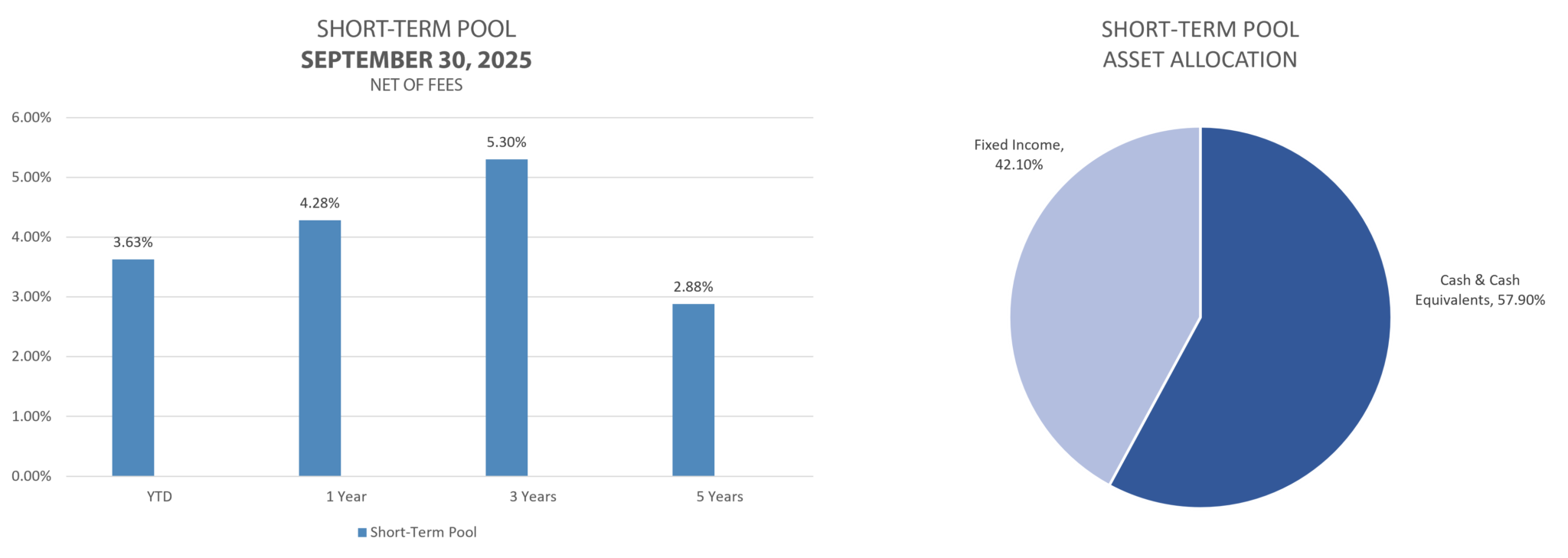

Waco Foundation works with donors and fund holders to ensure appropriate investment options for the purpose and timing of each fund. The Foundation offers five investment pools to provide flexibility in terms of growth and income over a variety of time horizons.

The Permanent Horizon pool is designed to remain steady and provide fund holders with a consistent stream of income and purchasing power over time. Assets are held in a conservative and prudently-managed portfolio that includes a mix of both active and passive investments.

The intermediate-term pool is designed to balance mild liquidity needs with a reasonable level of expected appreciation over full market cycles (low risk and small return). This pool is designed with a time-horizon between three and seven years.

The short-term pool is designed to provide a high level of liquidity for funds with short-term grantmaking strategies. This pool is for funds with a time-horizon of less than three years.

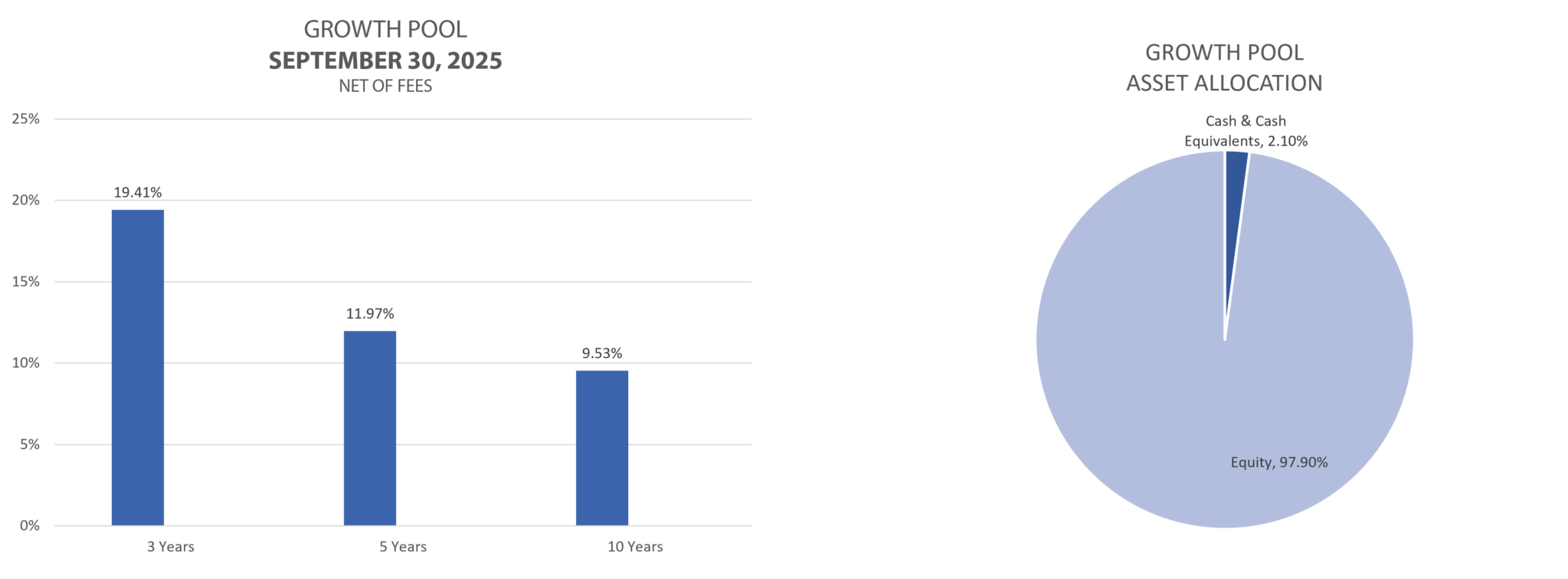

The growth pool is designed to mirror the market performance and experiences growth and fluctuations while adhering to an acceptable level of risk through equity level diversification. This portfolio has the highest risk, yet generally offers the highest return.

Waco Foundation’s fee structure helps subsidize the costs associated with managing component funds, resulting in more services available to the community. Unlike for-profit entities, Waco Foundation does not charge separate fees for administration, transactions and investment management. A flat fee is charged based on the fund type to promote simplicity and transparency. The Foundation is committed to helping local philanthropists and nonprofit organizations build their legacies and as such, are pleased to cover much of the costs of investing and administering the funds under management. View the fund fee structure here.

Waco Foundation has established a spending policy to simplify the process of grantmaking each cycle. The spending policy designates up to 5% of total assets, as determined on a 28-trailing quarter period, for grantmaking. This policy applies to both Waco Foundation’s Unrestricted Fund and the endowed component funds under the Foundation's management.

Get in touch

Interested in learning more or working with our Foundation? Let's talk! We look forward to hearing from you.